21 cents per mile for medical or moving purposes. The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes.

Mileage reimbursement is when a company reimburses an employee who used their personal vehicle (car, van, truck, etc.) for business use. Car expenses and use of the.

Tenncare benefit pays eligible members up to $.60 per mile for trips to and from medical appointments.

What Is The 2025 Mileage Reimbursement Rate Janey Lisbeth, The 2025 mileage rate was 65.5 cents per mile driven for business use. Tenncare benefit pays eligible members up to $.60 per mile for trips to and from medical appointments.

Federal Mileage Rate 2025 Alli Luella, 67 cents per mile for business travel. What is the 2025 federal mileage reimbursement rate?

Mileage Reimbursment 2025 Minna Sydelle, Mileage reimbursement is a form of compensation businesses provide their employees for using personal vehicles at work. 67 cents per mile for business travel.

Reimbursement Rate For Mileage 2025 Belita Annemarie, In 2025, efficient handling of employee mileage reimbursement not only supports fair employee compensation but also aids in maintaining compliance with legal. What is the federal mileage reimbursement rate for 2025?

Washington State Mileage Reimbursement Rate 2025 Filide Sybila, According to the irs, the mileage rate is set yearly “based on an annual study of the fixed and variable costs of operating an automobile.” here are the mileage rates for the year 2025: This guide explains everything, including rates and how timeero can help you stay compliant.

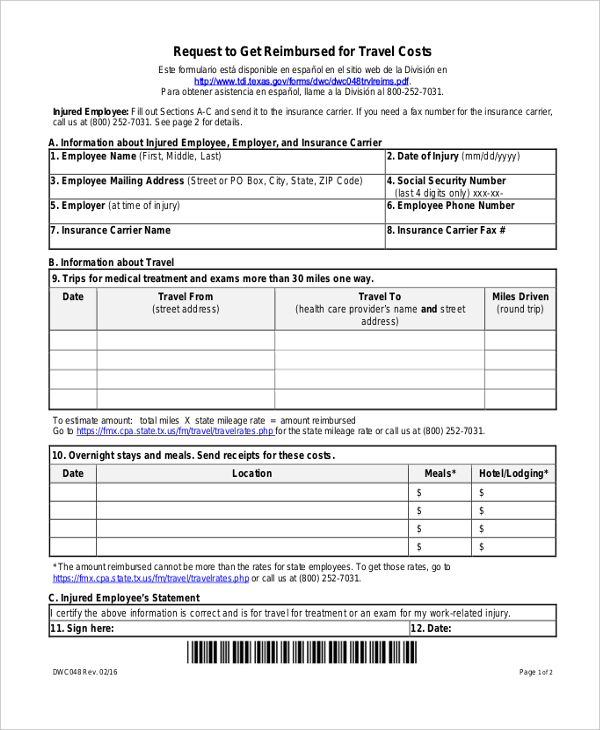

Workers Comp Mileage Reimbursement 2025 Amity Beverie, The 2025 mileage rate was 65.5 cents per mile driven for business use. 67 cents per mile for business travel.

What Is The 2025 Mileage Reimbursement Rate Janey Lisbeth, Unsure about california mileage reimbursement rules for 2025? 67 cents per mile for business travel.

Mileage Reimbursement 2025 Oregon Cora Meriel, The 2025 mileage rate was 65.5 cents per mile driven for business use. The irs has announced the new standard mileage rates for 2025.

2025 Irs Mileage Reimbursement Rates Dina Myrtia, Va travel pay reimbursement through the beneficiary travel program pays veterans back for mileage and other travel expenses to and from approved health care. The medical and moving mileage rate is 21 cents per mile, and the.

New York State Mileage Reimbursement 2025 Jess Romola, 14 cents per mile for service to. 67 cents per mile for business travel.