2025 Georgia Tax Brackets. This page has the latest georgia brackets and tax rates, plus a georgia income tax calculator. Georgia’s 2025 withholding methods use a flat tax rate of 5.49%.

1%, 2%, 3%, 4%, 5% and 5.75%. The georgia state tax calculator (gas tax calculator) uses the latest federal tax tables and state tax tables for 2025/25.

Right away, the scheduled changes would consolidate the six income tax brackets into two in 2025 and remain that way until 2032, when a flat tax would be.

Washington Tax Brackets 2025 Collie Katleen, This page has the latest georgia brackets and tax rates, plus a georgia income tax calculator. Georgia state income tax rates and tax brackets for 2025 (tax returns filed in 2025), georgia has six state income tax rates:

2025 Tax Brackets The Best To Live A Great Life, This page has the latest georgia brackets and tax rates, plus a georgia income tax calculator. Assuming delays are not required, following is the personal income tax rate schedule for january 1, 2025 to january 1, 2029:

Federal Tax Revenue Brackets For 2025 And 2025 Nakedlydressed, Calculate your annual take home pay in 2025 (that’s your 2025 annual salary after tax), with the annual georgia salary calculator. As of monday, the new year brought in a new tax rate, lowered from an income tax of 5.75% to 5.49%.

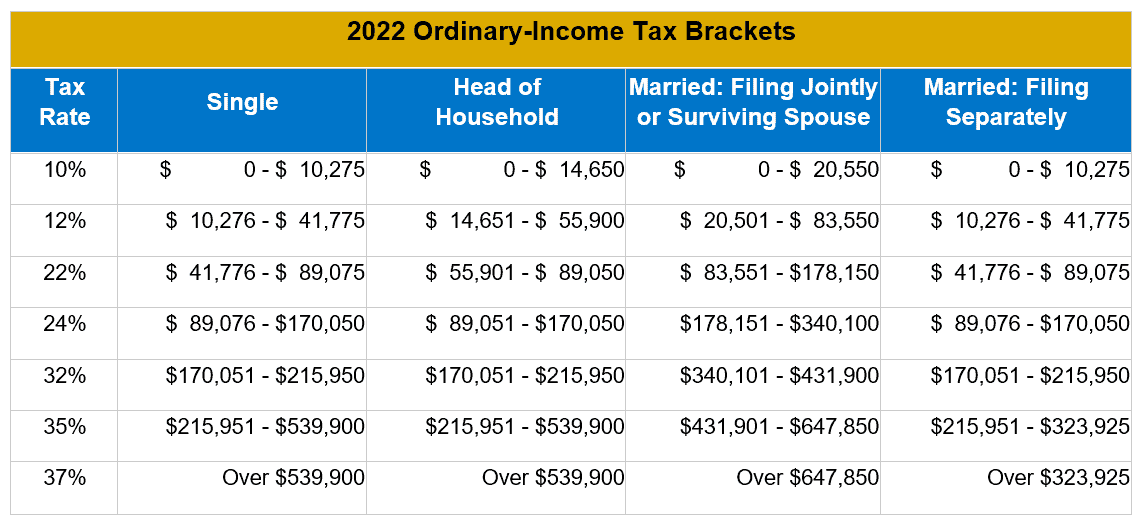

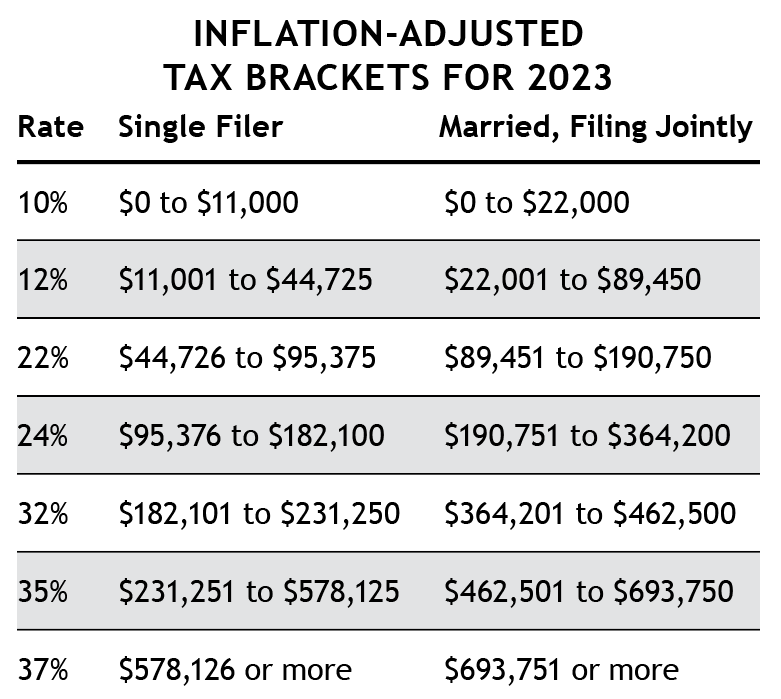

Tax Brackets for 20232024 & Federal Tax Rates (2025), In 2025 and 2025, there are seven federal income tax rates and brackets: 5.09% • january 1, 2029:

2025 CostofLiving Adjustments Tax Planning CPA Atlanta GA, Georgia's 2025 income tax ranges from 1% to 5.75%. As of that date, georgia gained a flat income tax rate of 5.49%, passed under a 2025 law that transitioned away from a series of income brackets that topped out at.

Tax Brackets 2025, As of monday, the new year brought in a new tax rate, lowered from an income tax of 5.75% to 5.49%. See current federal tax brackets and rates based on your income and filing status.

Tax Brackets 2025, Taxable income and filing status determine which federal tax. As of that date, georgia gained a flat income tax rate of 5.49%, passed under a 2025 law that transitioned away from a series of income brackets that topped out at.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Assuming delays are not required, following is the personal income tax rate schedule for january 1, 2025 to january 1, 2029: Georgia’s state tax code has a progressive income tax system that uses.

InflationAdjusted Tax Provisions May Boost Your 2025 TakeHome Pay, Assuming delays are not required, following is the personal income tax rate schedule for january 1, 2025 to january 1, 2029: 1, 2025, a change most taxpayers would notice when they filed their income taxes in 2025.

2025 Tax Bracket Changes PBO Advisory Group, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). 1, 2025, a change most taxpayers would notice when they filed their income taxes in 2025.